A 2016 study found that 80% of high net worth donors owned stocks, yet only 21% of them had made nonprofit stock donations. This discrepancy represents a significant opportunity for nonprofit organizations to take advantage of an underutilized form of giving and optimize their fundraising.

This article will walk you through everything you need to know about stock donations and why they’re important to your organization.

How are Stock Donations Different Than Cash Donations?

For major donors and other high net worth individuals, nonprofit stock donations can be a better option than cash. This is because stock donors can avoid capital gains tax on their appreciated stock assets by donating them and can take an income deduction of up to 30% of their adjusted gross income. As a result, you can unlock a larger pool of major donors.

For example, many donors don’t consider a stock donation as a viable giving option. When you ask for a gift in cash, the donor will look at their bank account “bucket”, but when you ask for a stock gift, they’ll look at their overall wealth “bucket”. For most, the overall wealth “bucket” is much bigger than the spending cash “bucket.” So, by re-evaluating their assets in this way, they may be able to afford a larger donation and create more impact.

Download a FREE Donor Profile Template

Use this template to record and track important information about your major donors, like stock holdings, so you can identify the right people for your next fundraising campaign.

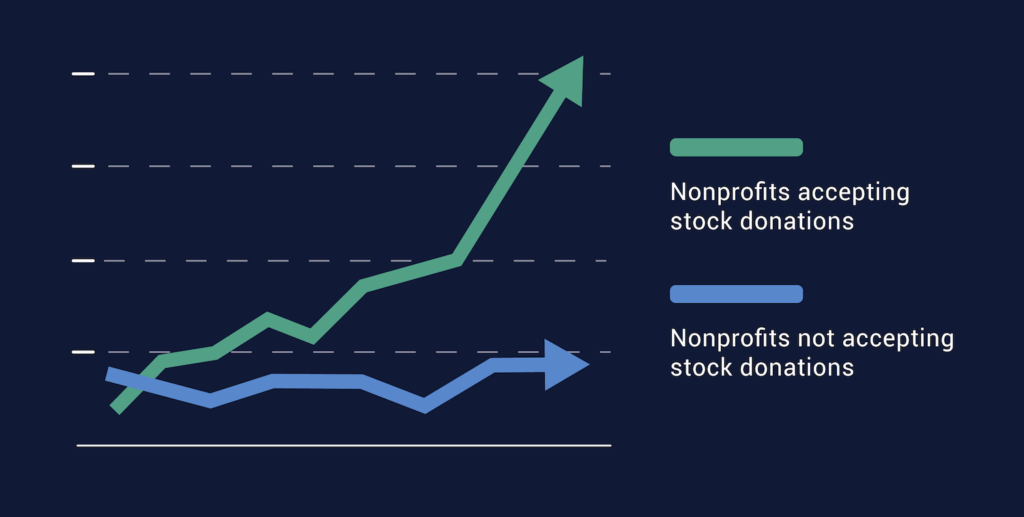

For nonprofits, stock donations also tend to be larger than cash donations. This is because there’s simply a lot more money to go around; 97-99% of United States wealth is held in assets such as stocks, bonds, and property. Further, a study found that focusing on non-cash gifts can help nonprofits grow six times faster than focusing on cash alone.

By fundraising for nonprofit stock donations, fundraisers can unlock a massive opportunity for their organizations. Not only can they solicit larger gifts, but they can also open their organization up to more opportunities.

How to Identify Stock Donation Prospects

Ideally, donors would approach you and beg to make stock donations. Unfortunately, fundraising isn’t that easy. Many donors don’t know that donating stock is even an option.

Even if they know it’s an option, they may not know how to actually do it. So, it’s up to fundraisers to identify stock donation prospects and offer them the necessary knowledge and motivation for them to make a donation.

Your major donors will be your best prospects for stock donations. You can cross-reference the giving capacity of these donors by accessing the SEC website and viewing stock holdings for publicly traded companies.

Additionally, many prospect researching tools will provide even deeper insight into someone’s capacity to give. For example, KIT aggregates data from external wealth screening partners to assess someone’s full capacity to give. Then, KIT automatically updates your donors’ Major Donor Scores, telling you the likelihood that someone will donate a major gift.

These features provide a more comprehensive overview of your donors and allow you to prioritize your outreach. This way, you can always reach the right donors at the right time and raise more for your cause.

3 Best Practices for Soliciting Stock Donations

Like any type of fundraising, soliciting stock donations is an art. Follow the three best practices below to master the art of the stock appeal.

1. Set up a brokerage account

To accept stock donations, you’ll need to set up a brokerage account: an account that accepts stock transfers and holds financial assets on behalf of your organization.

Many brokerage firms will offer a discount for nonprofits, so shop around to find out where the best deal is for your organization. Check out eCIO’s guide to structuring investment accounts for more information.

2. Create a stock donation website page

Like soliciting any type of donation, you need to remove any barriers that could deter donors. Try creating a stock giving page on your website that educates donors on how to donate stocks and prompts them to give. The SPCA has a great example of a stock donation form on its website.

Also, ensure that your form asks for contact information first, in case they leave the form before finishing. Stock donations can require a few more steps on their end than a regular donation, so you want to be able to reach them and help them get over any hurdles.

3. Make the right ask

Your approach to soliciting a stock donation may differ slightly from a traditional major gift ask.

Gifting stock will be a new process for many donors, so ensure you’re guiding them to a donation without being overbearing. One way to do this is to use social proof to make donors more comfortable with giving. For example, showing them other donors who have donated stock may be enough to incentivize them to explore the option for themselves.

Also, make sure to highlight all of the benefits of donating stock. Who doesn’t want to save on their taxes while making a more impactful donation?

Additionally, donor analytics tools such as KIT can allow you to perfect every element of your ask. For example, Fundraising KIT’s Smart Ask feature ensures you’re asking for the right amount of money every time. By analyzing a donor’s giving history and demographic data, the Smart Ask tool suggests an amount that maximizes your donor’s generosity without asking for too much.

Get Started With Smart Ask

Using Fundraising KIT, you can enrich your fundraising data with Smart Ask. Book a demo today to learn how to take your fundraising to the next level.

Organizations that receive at least one stock gift every year grow, on average, 55% faster than organizations receiving cash gifts. With stats like this, you should be jumping out of your seat to start accepting stock. And using the information and resources shared in this article, you’re well on your way to raising more for your cause.

Ally Smith

Content Writer at Fundraising KIT

With a passion for nonprofit innovation, Ally has spent her career helping build community capacity and supporting social innovation as a customer success manager turned, youth worker, turned social researcher.

After leaving the tech start-up landscape, she pursued a Master’s in Philanthropy and Nonprofit Leadership and has since supported nonprofits to innovate and grow. A Canadian ex-pat and social entrepreneur based in Edinburgh, she enjoys hiking, baking bread in a panic, and pursuing the full Scottish experience- rain and rugby included!