Disclaimer: The information provided in this article does not constitute investment advice, financial advice, trading advice, or official advice of any sort. Perform reasonable due diligence, and please consult a financial advisor and tax advisor before making any financial decisions.

Over the past decade, Bitcoin and other cryptocurrencies have become increasingly popular and viewed as legitimate forms of currency worldwide. So naturally, nonprofit leaders and fundraisers are interested in how their organizations can begin accepting cryptocurrency donations.

There are massive benefits to cryptocurrency (crypto) donations once nonprofit leaders and fundraisers overcome a small learning curve.

This article will teach you what you need to know about crypto and how it can optimize your fundraising strategy. Here’s a full outline:

What are Cryptocurrencies?

To make a long story short, cryptos are digital currencies secured by cryptography: a series of algorithms coded in a way that stores and communicates the currency securely. There are various popular cryptos:

- Bitcoin

- Ethereum

- Binance Coin

- Tether

- Solana

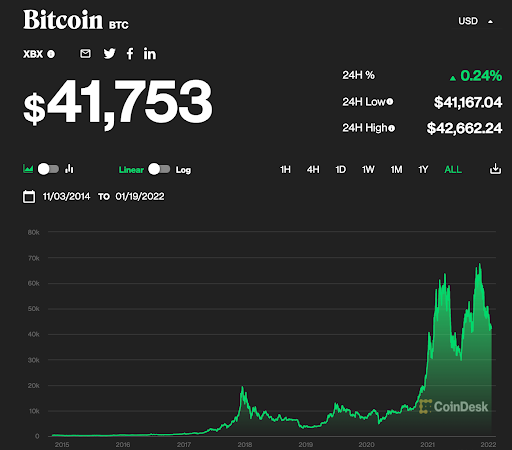

Cryptos have become increasingly valuable over the past decade. By looking at the increasing value of Bitcoin since 2015, it’s clear that more and more people around the world are getting comfortable with buying, selling, and trading cryptos.

Additionally, many cryptos are based on blockchain technology that allows the currencies to operate within a secure ledger of transactions. Blockchain is a computer database that stores information in connected groups, or “blocks”. As users enter new data, it fills a block that, when completely filled, is attached to the previous block, creating a chronological sequence of information.

Users can store all sorts of data in a blockchain, such as personal information, legal documents, and financial transactions.

Talk to a fundraising expert today to learn more about how Fundraising KIT can quickly and easily help your nonprofit raise more for your cause.

What are the Benefits of Cryptocurrencies?

Blockchain ensures the integrity of cryptos and provides significant benefits to users. Namely, crypto offers the benefits of security, decentralization, and transparency.

1. Security

Crypto secured by blockchain is essentially impossible to counterfeit or double spend. Every block in a blockchain sequence has a unique timestamp that secures it within a series.

Critically, each block also contains a hash code and the hash of the block before it. Therefore, as each block contains two hashes, the security of one block is ensured by the entire sequence.

For instance, if a hacker wanted to steal or alter any data within a block, it would disrupt the entire sequence. Then, the other users would easily identify the hacker’s alterations, which would be condemned as illegitimate.

2. Decentralization

The most popular cryptos are controlled by a community of individuals rather than a central authority.

Bitcoin, for example, stores its user data across a community of computers. Within this system, users don’t have to trust a centralized entity like a bank to regulate their assets. Transactions can happen anytime, quickly, internationally, anonymously, and without the approval of a higher authority.

For donors, decentralization is attractive because it means lower processing fees, the ability to donate internationally, and the assurance that donations will get into the hands of beneficiaries.

3. Transparency

Every Bitcoin transaction can be viewed by Bitcoin users or by visiting blockchain explorers. However, users can register anonymously, meaning they can be as transparent as they want to be. Important for nonprofit professionals, blockchain technology provides an excellent platform for those who wish to demonstrate the highest level of transparency.

One of the biggest demands of millennial donors is transparency. They want to know exactly where their money is going, the impact they’re creating, and internal organizational practices. You can show these donors that you are committed to transparency by accepting Bitcoin donations.

Track Your Fundraising Performance with this FREE Dashboard

With this fundraising analysis dashboard, you can track the metrics that matter and assess your campaign’s performance over time.

Three Ways for Nonprofits to Accept Cryptocurrency Donations

For nonprofit professionals, there are three main ways to accept crypto donations:

1. Use a cryptoprocessor

The simplest option is to find a platform to help you immediately convert crypto to your local currency. Two popular international platforms for currency processing are BitPay and Coinbase.

However, keep in mind that platforms like these are centralized entities that charge transaction fees, reducing the value of any donation. Also, if you cash out a crypto donation, you’ll be unable to relay the benefits of crypto to your stakeholders.

2. Open a personal wallet

Opening a personal wallet is the more efficient way to accept crypto donations. A crypto wallet is a device or service that holds the keys to access your crypto.

Having a wallet allows you to manage your donations directly and buy and sell with ease. This method will limit transaction and conversion fees while giving you more control over your crypto finances. To learn more, check out Investopedia’s guide to Bitcoin wallets.

3. Use a donation platform

The final way to accept crypto donations is by using a crypto donation platform. For example, GiveTrack and The Giving Block are nonprofits dedicated to providing other nonprofits with a safe and secure crypto donation mechanism.

These organizations will help you drive crypto donations worldwide while minimizing transaction costs and maximizing transparency. Also, The Giving Block provides various crypto solutions for nonprofits and donors, including resources on donating, fundraising, and managing cryptos.

How to Get Your Nonprofit Ready for Cryptocurrency Donations

There are a few more things nonprofits, in particular, should do to get ready to accept crypto donations.

1. Develop a crypto gift acceptance policy

Having rules about how you will and won’t accept crypto is a great way to set the parameters for your fundraising. As we know, there are many ways to accept crypto donations. So, it’s important that you clearly communicate the best way for donors to give to you.

Check out the National Council of Nonprofits gift acceptance policies overview to find resources on crafting a clear and helpful policy.

2. Think about anonymity

Donors can give crypto anonymously. While you can trace a donation via an ID, you may never know the person behind the ID. This can be a draw for donors who wish to remain anonymous but could pose a risk to your nonprofit. Think about what level of transparency your organization is comfortable with.

For example, Save The Children requires that all individuals donating crypto provide at least an email address to receive a tax receipt for their contributions.

3. Provide the right expectations and receipts

The IRS classifies crypto donations as property, meaning they aren’t subject to capital gains tax and are tax-deductible. This classification makes donating crypto an exciting option for major donors. This also means that crypto donations should be receipted similarly to in-kind or other property donations.

In Canada, tax receipts can be issued much the same way as in the US. However, Canadian donors are responsible for paying any capital gains taxes associated with their donation tax receipts. This reality should be made clear to donors.

4. Crypto donations aren’t going anywhere

Crypto is growing fast. From 2020 to 2021, The Giving Block’s Crypto Giving Tuesday campaign increased by 583%! So, makes sure your campaigns are equipped to accept crypto donations, especially campaigns like capital campaigns that will attract major donors.

Crypto is a movement, and the sooner you start to invest in it, the sooner you can experience its benefits.

Download a FREE Donor Profile Template

Keeping track of donor data is essential to effective fundraising. Use this template to record and track important information about your major donors and prospects.

Hopefully, after reading this article, you’re a bit more comfortable with crypto as a concept and a fundraising avenue. Also, please explore the resources linked throughout the article to get started with accepting crypto and providing your nonprofit with another funding option.

Ally Smith

Content Writer at Fundraising KIT

With a passion for nonprofit innovation, Ally has spent her career helping build community capacity and supporting social innovation as a customer success manager turned, youth worker, turned social researcher.

After leaving the tech start-up landscape, she pursued a Master’s in Philanthropy and Nonprofit Leadership and has since supported nonprofits to innovate and grow. A Canadian ex-pat and social entrepreneur based in Edinburgh, she enjoys hiking, baking bread in a panic, and pursuing the full Scottish experience- rain and rugby included!